WIMBERLEY— On Wednesday, Nov. 13, the city of Wimberley hosted a town hall meeting at the Wimberley Community Center to discuss potential options to repair and maintain roads in the city.

According to the presentation, Wimberley, which was incorporated as a city in 2000, has seen an 11% increase in population — from 2,598 to 2,881 — over the last 24 years and does not require residents to pay a city ad valorem property tax. Instead, the city has other forms of income, which include:

• Sales tax

• Franchise tax

• Grants

• Blue Hole Fund

• Hotel Occupancy Tax (HOT) funds

• American Rescue Plan Act (ARPA) funds

• Other The majority of these income sources are restricted for certain uses, based on state legislature or program guidelines.

For example, the Blue Hole Fund is only allowed to be used for the Parks Comprehensive Master Plan and the Hike and Bike Trail at Blue Hole Regional Park, while HOT funds are restricted to items such as lighting on The Square, crosswalk art, the welcome center on Old Kyle Road, the Christmas tree and advertising. ARPA funds and grants also have their own allocations.

The unrestricted income includes sales tax, franchise tax and other miscellaneous income, with sales tax being the largest portion of the three.

According to the presentation, the city collected $429,000 in sales tax in 2005 and $1,551,000 in 2023 and is estimated to collect $1,688,000 in 2024.

Of the unrestricted income, the city spent 3839% on personnel/benefits for fiscal years 2023 and 2024 and expects to spend approximately the same percentage in FY 2025. Other uses for this income include contract service/tech, supplies/ maintenance, Oak Drive payment, other services and charges and road maintenance.

In FY 2023, the city allotted $270,000 for road maintenance. This increased to $346,000 in FY 2024 and is expected to be $405,000 for FY 2025.

In anticipation of the need to increase funds for road maintenance, the city performed a community survey. Of the 168 surveys received, 100 were from residents in the city limits, 40% of which supported a property tax and 60% of which supported a road bond. The additional 68 surveys received were from residents outside of the city limits.

In March 2024, the city engineering firm began performing street surveys using the pavement condition index (PCI). According to mayor Jim Chiles, PCI looks for cracking, potholes/ruts, edge failures and ride comfort, but does not include surveying drainage improvements, roadside conditions, private roads in the city limits, public roads with planned improvements (Wimberley Square, Old Kyle Road) or surveys/construction plans. The index scores road conditions from 0-100; the higher the score, the better the condition of the road.

Based on the severity of pavement degradation, there are three options for remediation:

• Seal coat: The least intense form of repair; this involves applying a layer of asphalt binder (oil) to seal minor cracking and rehydrate the pavement.

• Mill and overlay: Removes the top layer of asphalt and applies a new layer.

• Full depth reconstruction: The most intense form of repair, which includes removing and replacing all asphalt and base.

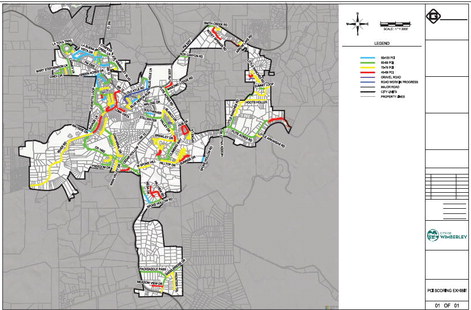

The city provided a color-coded map that includes the condition score for the 35 miles of city-owned roads in Wimberley.

Based on the road survey, the council and staff calculated the cost of the needed work to be approximately $16 million for paving only. This estimate does not include curbs, drains, sidewalks or driveway entries. Total, for all of the necessary work, along with a cushion for inflation, the city is estimating $25 million.

Additionally, staff and council identified a few different options to finance the work. These options include:

• Imposing a property tax

• Allowing residents to vote on a road bond

• Creating public improvement districts or property owner association take over

• No new funds-continue maintenance and small projects “We currently have a property tax on our books that we can impose, it’s just currently set at 0%,” explained Chiles. “We don’t really want to do that; we want residents to be a part of this process.”

“I think [the road bond] is probably the better option and that’s what the survey [said] most people were okay with doing,” the mayor continued. “If we were to impose a city tax on this, when the roads get paid off — however many years it takes — we don’t know what council is going to be in here and they may not take it back to zero …” Next, Jorge Delgado, senior vice president/ investment banker with Hilltop Securities Inc., spoke with attendees about the specifics of a potential road bond.

If the city were to call a bond election, the first day to do so for the May 2025 election would be Feb. 2, 2025, and the last day would be Feb. 14, 2025. City residents would then vote on the proposition on May 3, 2025. If passed, the city would be able to access the bond funds as early as August of 2025.

As currently proposed, the bond amount would be $25 million for a 25-year term. The estimated annual debt service payment would be $1,685,976 and the total estimated debt service of the program would be $42,149,393.

Based on the 2024 average homestead taxable value of $608,654, as provided by the Hays Central Appraisal District, the projected annual tax levy would be $852.12 or $71.01 per month, per household.

Following the presentation, residents in attendance had the opportunity to provide comments and ask questions of the council. Many of the property owners in the city limits, as well as those outside the city limits, were concerned that only those in the city limits would be responsible for roads that everyone uses and questioned if there was a way that the burden of road costs could be spread out more evenly across all residents. To this, mayor Chiles confirmed that things, such as raising sales taxes or taxing non-residents were not options available to the city.

Others questioned the plan for how the roads would be maintained, should the bond come to fruition, and what would happen if the roads need to be repaired again prior to the bond being paid off.

Although the mayor and council did not have answers for all of the questions asked, the mayor emphasized that a road bond election is not set in stone.

“Thank you all for coming and your comments and we hear you,” Chiles concluded. “We’re not sure what we are going to do yet, but you’re going to be involved, one way or the other.”

For more information on Wimberley road maintenance and to view the town hall presentation, visit www.cityofwimberley.com/456/Road-Maintenance-Plan.