AUSTIN — Hays County Emergency Services District (ESD) No. 1, which provides emergency medical services to a portion of the county, has called for an election that, if approved by voters, would increase the tax rate.

History

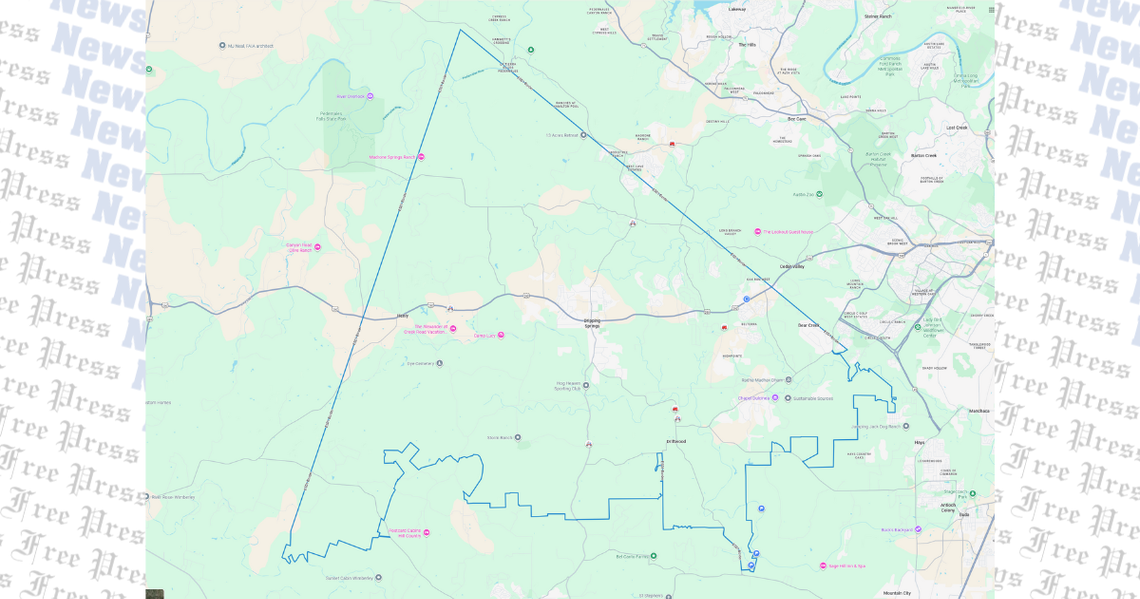

The ESD covers 35% — stretching across 244 square miles — of the northern portion of Hays County, primarily in the jurisdictions of Driftwood, Dripping Springs and Henly, and serves approximately 55,000 residents. Since being the first ESD formed in Hays County in 1987, it has been pulling tax money from the district in order to provide emergency medical services to that portion of the county.

In 1987, the tax rate was set at $0.025 per $100 valuation and the tax cap — which is how high an ESD can go without voter approval — was $0.03, explained chief Bob Luddy. Then, in 1990, the tax rate itself was increased to $0.03 and has stayed the same since.

In 2016, an election was held to raise the cap to $0.10, but that was unsuccessful, until it was later approved in 2023.

“That gave us the ability to raise our cap to $0.10. We’ve been at $0.03 [for the tax rate] since 1990 and now, we are trying to raise the actual rate,” Luddy said. “Where we are right now with our tax cap, we are at the $0.10 per $100 valuation and that is the maximum that any ESD in the state can go to on their cap by law, but that is not where our rate is at.”

Tax rate election

On Nov. 4, an item will be on the ballot for voters who are within Hays County ESD 1’s taxing borders, which will ask to approve the ad valorem tax rate of $0.05 per $100 valuation, higher than the current rate of $0.03. This is the first time that Hays County ESD 1 is holding an election on the tax rate itself — the district is not allowed to raise the rate significantly without going to an election, even though the cap is at $0.10, Luddy said.

The current $0.03 per $100 valuation rate is the lowest among other ESD’s in Hays County, according to the district, where the average is $0.08. The proposed rate remains below the county average and below the state cap. In 2024, all ESDs in Blanco and Caldwell counties had a tax rate of $0.10 per $100 valuation, as well as adjacent ESDs in Travis County had a tax rate ranging from $0.075.

“We're currently at $0.03 per $100 valuation and we're asking to go up to $0.05 per $100 evaluation. The average home taxable value in our district is about $500,000,” the chief said. “So, on a $500,000 house, this rate increase would increase their annual taxes [by] $100, which is about $8.33 per month.”

The heightened population growth has caused the ESD to experience a higher emergency call volume — more than 2,800 calls annually. Currently, the medics work a minimum of 834 overtime hours per year, leading to concerns about fatigue, burnout and potential impacts on response times.

According to Luddy, the proposed tax rate increase would provide funding to:

• Hire additional medics to establish a fourth shift of approximately 14 personnel, reducing annual overtime to approximately 312 hours per medic

• Maintain 24/7 ambulance coverage across all service areas

• Ensure personnel are rested and prepared to respond

• Align response times with national standards

• Maintain essential equipment and ambulances

If the tax increase is not approved, Hays County ESD 1 would revert back to the voter-approved rate of $0.034435 per $100 evaluation, which is set by the state. There are “nuances” to the tax rate every year, which allow districts to increase above the $0.03 cap without going to an election, designed to offset inflation, Luddy explained.

“That means that we will not have the funds to hire the additional paramedics, to bring on that fourth shift and to add additional personnel to our continuing education department. The reason that we would like to fund the fourth shift is due to how the 24/7 365 scheduling works to provide coverage around the clock for our district,” he said. “Because of the hours that [the paramedics] work, they work 832 hours of overtime annually built into their schedule. They work almost a third more than a typical full-time job, [so] bringing in a fourth shift would allow us to decrease that built in mandatory overtime to approximately 312 hours per paramedic.”

Early voting is between Oct. 20-31 and Election Day is Nov. 4. More information on the election can be found at www.hayscountytx.gov/elections/20251104.