Hays County Appraisal District sees record number of protests

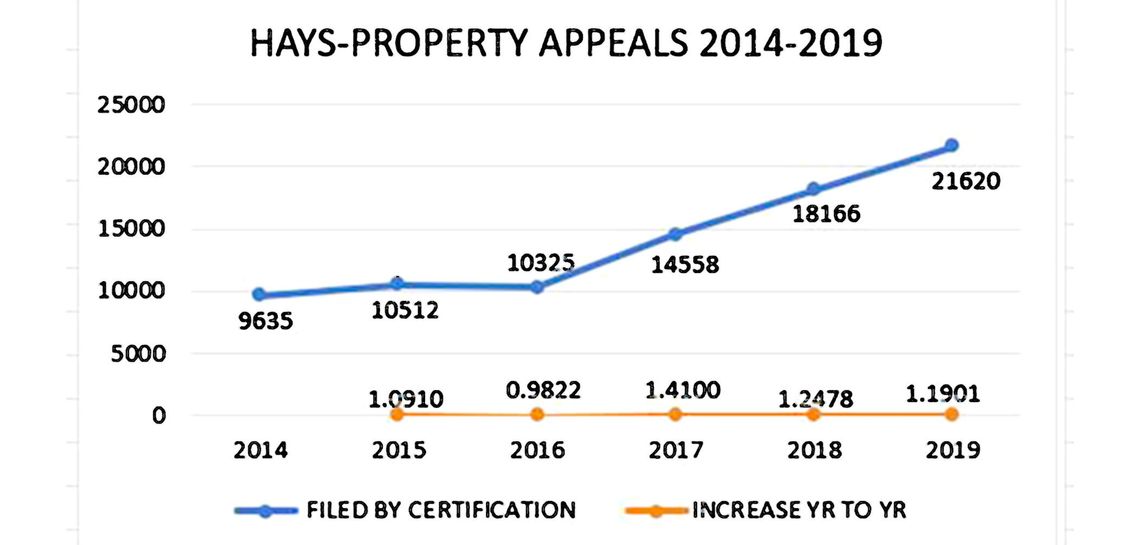

Rising property values and a record number of protests are causing heartburn for residents, highlighting a statewide discussion on the property appraisal system.

For Buda resident Charlie Thompson, his land valuation where his home is built skyrocketed 65% and a protest before the Hays Central Appraisal District means his slightly reduced valuation will only save him some $40 this year over what was proposed.

PLEASE LOG IN FOR PREMIUM CONTENT. Our website requires visitors to log in to view the best local news.

Not yet a subscriber? Subscribe today!