PLEASE LOG IN FOR PREMIUM CONTENT. Our website requires visitors to log in to view the best local news.

Not yet a subscriber? Subscribe today!

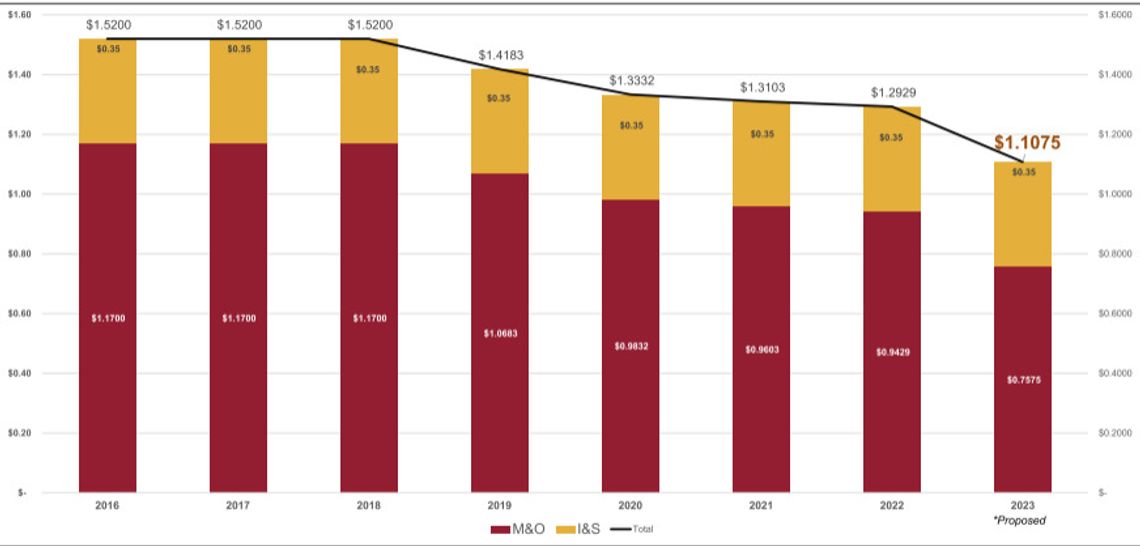

Dripping Springs ISD approves reduction in tax rate for FY 2023-24

By Megan Navarro DRIPPING SPRINGS — Dripping Springs ISD is moving forward with a reduction in its tax rate for the 2023-24 fiscal year.